Chicago Development Fund (CDF) has been certified as a Community Development Entity by the CDFI Fund division of the US Treasury, allowing CDF to use NMTCs to provide subsidized financing for qualifying businesses or real estate projects. Borrowers of NMTC funds must meet the Federal definition of a Qualified Active Low‐Income Community Business (QALICB) as set forth in the NMTC program overview to be eligible for NMTC financing. In general terms, QALICBs are businesses that are predominantly or wholly located in Low‐Income Communities.

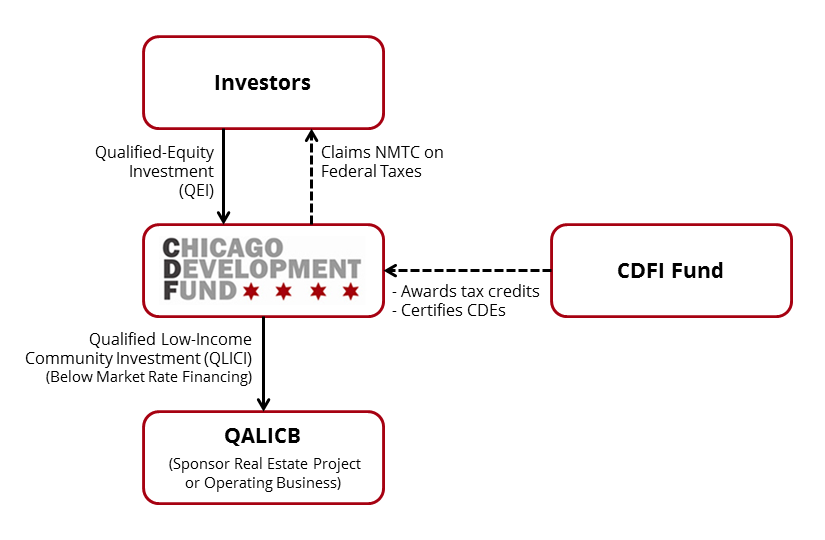

Chicago Development Fund obtains funds to invest in QALICBs through private investors. The NMTC program provides these investors with federal income tax credits based on equity investments made in CDF’s subsidiaries. This investment is known as a Qualified Equity Investment (QEI). Investors receive a tax credit for 39% of a QEI, which is claimed over a seven‐year schedule. A QEI must remain fully invested in CDF for seven years in order for an investor to meet NMTC compliance requirements. CDF then uses the QEI capital to provide below‐market rate equity or debt capital to qualifying businesses or real estate projects. The capital that a CDE provides to a qualifying project is known as a Qualified Low‐Income Community Investment (QLICI). CDF typically structures its QLICIs as interest‐only loans with a seven-year or greater term in order to mirror the NMTC compliance period for QEIs. Because the NMTC benefit is defined as a percentage of the equity investment CDF receives, the amount of subsidy a project can receive is dependent upon the size and cost of the project itself.

The NMTC structure differs from that of many other federal tax credits because the NMTC investor indirectly finances a project through the CDE. Typically, with programs such as the Low‐Income Housing Tax Credit or the Historic Tax Credit, the investor receives a tax benefit for investing directly in a project. In NMTCs, the tax credit investor invests money with CDF, not the project. CDF in turn provides below‐market financing to the project, most commonly in the form of debt.